Cash flow management is key to Amazon seller success. Even profitable businesses can stumble if cash is not flowing freely. With Amazon’s twice-a-month payment cycle and initial costs for inventory and advertising, sellers tend to get caught with their hands out. Here are eight practical tips to keep you with a good cash flow and thriving in business.

Why Do Most Amazon Sellers Fail? The Only Reason Is Cash Flow.

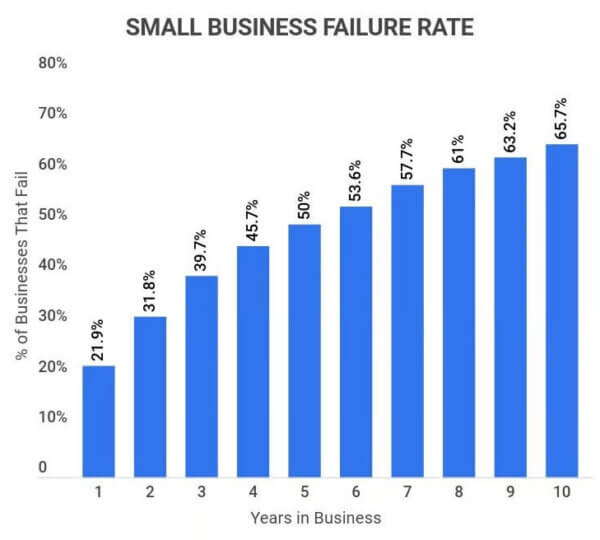

As reported by SCORE, a U.S. Small Business Administration resource partner, 82% of small businesses fail because of cash flow issues. This fact highlights the paramount importance of proper cash flow management for Amazon sellers.

Additional factors contributing to small business failures include:

42% fail due to a lack of market need for their product or service

29% run out of cash

23% lack the right team

19% are outcompeted by rivals

These statistics demonstrate that even though multiple issues can affect a business, cash flow problems are still the leading cause of failure.

8 Essential Strategies for Amazon Sellers in 2025

1. Boost Your Amazon PPC Billing Threshold:

Amazon generally bills you for Pay-Per-Click (PPC) advertising once your spend level is at or over $500 or every 30 days, whichever occurs sooner. By getting an increase in your billing limit—possibly to $10,000—you can postpone these fees, giving you additional time for your sales to create revenue prior to when they will deduct their expenses. This modification can really be a benefit to your cash flow.

2. Use 0% Interest Business Credit Cards:

Most business credit cards have 0% interest promotion periods lasting 12 to 15 months. They are used for business expenditures such as inventory expenditures or adverts, which push payments back without a single dollar’s interest, creating time for turning sales into cash. Some people have negotiated lower interest rates or refunds by simply calling their credit card companies and asking them to make changes.

3. Pay Vendors with Credit Cards through Melio:

Melio enables companies to pay contractors and vendors via credit cards, even if the vendors do not take cards directly. The service allows you to pay later during your next billing cycle, enhancing cash flow. Melio facilitates payments to different vendors, including international vendors, and provides bank transfer or mailed check options

4. Adopt Pay-As-You-Sell (PAYS) Insurance:

Amazon insists that merchants whose monthly revenues exceed $10,000 must hold Commercial General Liability Insurance. Conventional insurance plans tend to demand large up-front payments tied to anticipated sales. PAYS insurance varies premiums with actual sales so you can pay more when revenue is high and less when it is low, matching insurance premiums to your income.

5. Negotiate Favorable Terms with Suppliers:

Reducing inventory costs can significantly impact your cash flow. Engage with suppliers to negotiate better pricing, extended payment terms, or additional benefits such as:

Extra quality checks to minimize returns

Enhanced packaging to increase product value

Free product inserts for branding and promotions

These negotiations can lead to cost savings and improved product offerings.

6. Optimize Inventory Management

Efficient inventory management prevents capital from being tied up in unsold stock. Implement strategies such as:

Accurate demand forecasting to align inventory levels with sales

Just-in-time inventory practices to reduce storage costs

Bundling slow-moving items with popular products to boost sales

Offering discounts to clear excess inventory

These approaches help maintain liquidity and reduce holding costs.

7. Regularly Monitor and Forecast Cash Flow:

Constant tracking of your cash flow enables you to prepare for shortfalls and strategize in advance. Use accounting programs such as Xero or QuickBooks in combination with accounting programs such as Link My Books, to bookkeep automatically and provide real-time cash flow statements. This inter-operability enables sales, expenditure, and profitability metrics across multiple platforms.

8. Shorten the Cash Conversion Cycle

The cash conversion cycle measures the time between purchasing inventory and receiving payment from customers.

To shorten this cycle:

Negotiate faster payment terms with Amazon or explore services that offer quicker access to funds

Implement efficient inventory turnover strategies

Use tools like the Payability Seller Visa Card, which provides immediate access to a portion of your daily sales, enhancing cash flow flexibility

Conclusion:

Effective cash flow management is vital for the sustainability and growth of your Amazon business. By implementing these strategies, you can ensure a steady flow of funds, reduce financial stress, and position your business for long-term success.